“Flood maps are made by man. Water is water and it will go where it wants to go—when it wants to get there.” Chris Huebener, Agency Equity Partner

Brightway recently held an internal forum on the significance of flood insurance. The discussion spanned personal flood experiences, common client objections, and the new options for selecting the right flood policy for homeowners.

“I have seen more personal pain with flood claims than with wind-related claims,” says Agency Owner, Sam Kassar.

Our agents are uniquely positioned to be close to both their clients and the insurance carriers who handle claims. One key theme from the forum was the devastating impact of floods that our agents have witnessed firsthand. Floods often displace homeowners for longer periods than wind-related events. Water damage permeates everything, leading to mold and decay that are hard to remediate. Some of our agents have stories of grateful clients who benefited from having flood insurance after a flood event. Unfortunately, others have clients who suffered severe losses because they opted out of flood coverage.

Changing weather patterns have led to an increase in floods across the US, even in areas that previously did not experience such events. For example:

- Hurricane Harvey caused inland flooding in Houston

- Hurricane Ian led to flooding from inland lakes and rivers in Florida

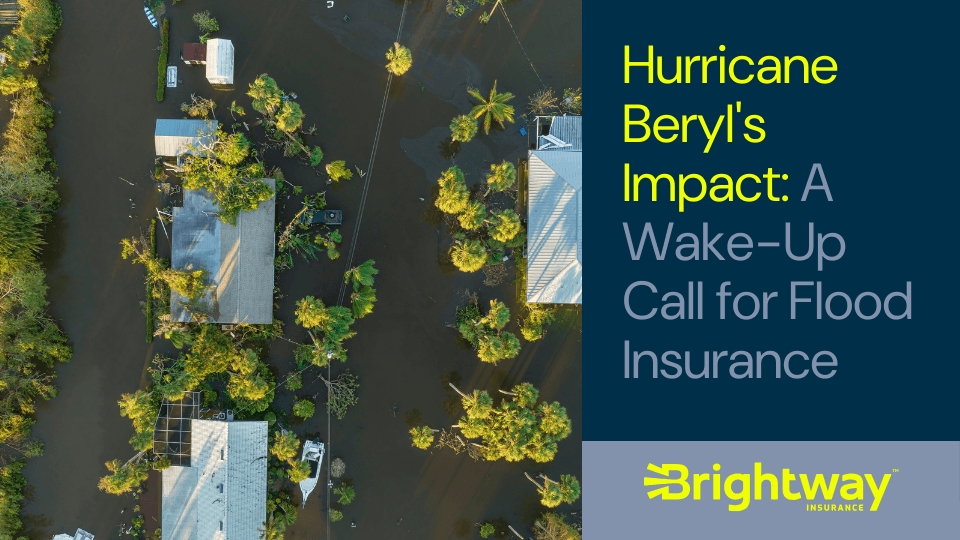

- Hurricane Beryl's impact was felt from Texas to Vermont

These incidents emphasize that floods can happen anywhere, regardless of flood zone designation.

Addressing common objections:

- “My homeowners insurance covers flood.” This is not the case unless a specific flood endorsement is included in your policy. More homeowners insurance carriers are likely to require separate flood insurance policies in the future.

- “I am not worried about my pipes breaking.” Pipe breaks are not considered flood claims and may not be covered by your homeowners policy unless you have water back-up coverage. A good agent will help identify and fill any coverage gaps.

Options are always beneficial. There are two types of flood insurance: private and public (NFIP). This choice allows for better price comparisons and coverage options, ensuring clients get the right policy for their needs and budget.

- Private flood insurance often offers more extensive and unique coverages, such as "loss of use," which helps with the costs of not being able to stay in your home after a flood event.

- NFIP has also undergone changes, and flood zones have been updated in many areas.

Your Brightway agent is here to guide you through these options, helping you choose the best possible flood insurance for your home. We even offer special flood links where you can quickly check the price of private and NFIP coverage online.